Rest Assured with the Right Reinsurance

Luminare Health doesn’t believe in “one size fits all” solutions, especially when enabling reinsurance solutions. That’s why we offer an array of stop-loss coverage options that help protect employers from high medical claims, and, most importantly, the consultative approach to help clients select the carrier that best fits their unique needs. Employers can rely on our team to help them find the best reinsurance coverage options for their plan from one of the stop-loss carriers we work with.

Download our flyer to learn more about Luminare Health's stop-loss solutions.

Preferred Stop-loss Providers

Trust your investment with one of our preferred, integrated providers:

|

|

|

Expert Experience, Best-in-Class Relationships

With 50+ years in the self-funded health benefit plan industry, we’ve built strong relationships with our preferred stop-loss vendors and negotiated rates and unique carrier solutions that significantly benefit our clients. Our large book of business and established place as an industry leader enable us to advocate for our clients in ways other TPAs cannot.

Our underwriting team of stop-loss experts can tailor a comprehensive solution that includes:

Our underwriting team of stop-loss experts can tailor a comprehensive solution that includes:

- Recommendation on type of stop-loss (specific, aggregate, or both)

- Deductible options

- Aggregate factors that match the client’s goals and risk tolerance

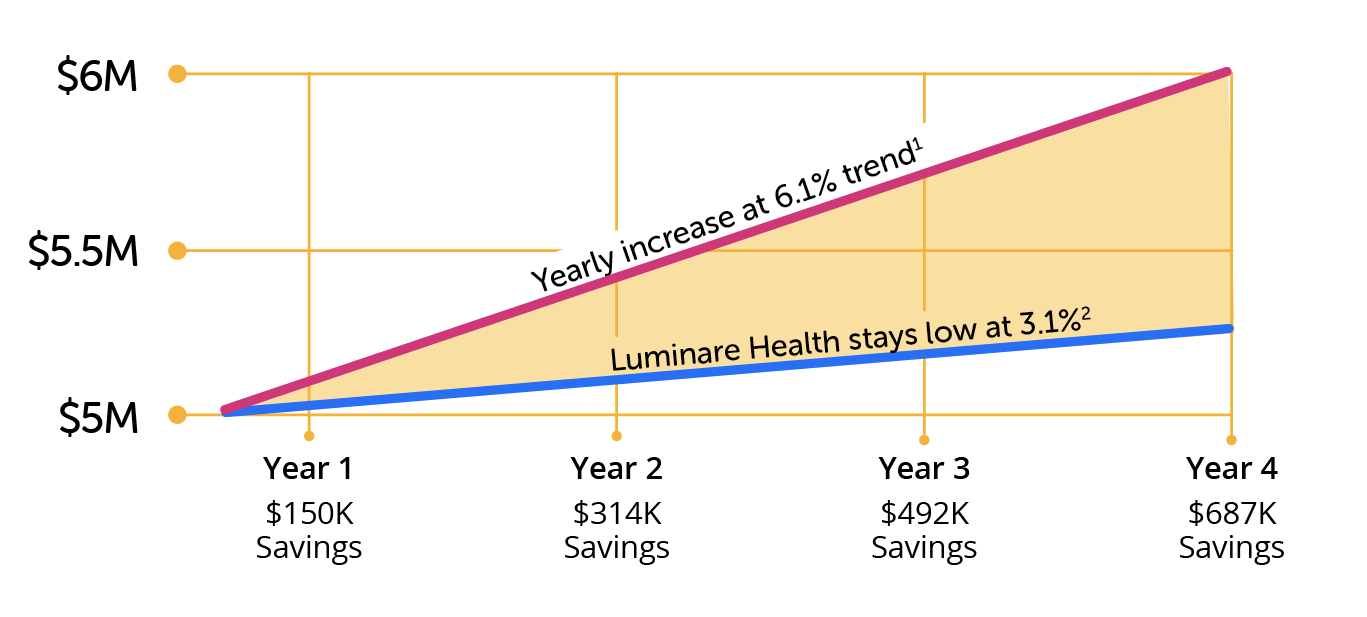

Low Medical Trend

Compared to industry benchmarks, Luminare Health’s 4-year average trend of just 3.1%* means significant savings for our clients. But just how significant are the savings? When compared to an industry benchmark trend of 6.1%**, over a 4-year period, Luminare Health’s 3.1% trend brings almost $1.6M in savings, based on $5M spend.

Connect with a Luminare Health sales executive to learn more.

*Allowed medical claims for our standard TPA business, excludes Rx claims, fees, and other costs. Benchmarks and our medical trend are not calculated on the same basis. Potential differences include but are not limited to: COVID impacts, inclusion of Rx benefits, fees, and other costs, some benchmarks are based on average expected trend rather than actual claims.

** 3-year average, PWC medical cost trend

** 3-year average, PWC medical cost trend